- Moto Capital

- Posts

- Truth Machines

Truth Machines

The Superintelligence Race

Disclaimer: This post contains thoughts on crypto, a volatile and risky asset class. It is not investment advice, and you should do your own research. All information is for educational purposes only. Please don’t take risks with money you’re not willing to lose.

Markets and AI models can be seen as two sides of the same coin, each capturing collective intelligence in their own way. While AI is lauded as a disruptive force with limitless potential, markets remain underappreciated, frequently seen as tools for pricing assets rather than mechanisms of truth discovery. This discrepancy is puzzling, given that markets have been evolving for centuries, absorbing human actions and beliefs to reflect realities in real-time. Think of markets as living, breathing entities that process a continuous stream of inputs—from macroeconomic indicators to individual consumer choices. They don’t just react to events, but often anticipate them, pricing in probabilities long before they become apparent. In this sense, markets function as a form of general intelligence, not unlike AI models trained on vast datasets to identify patterns and predict outcomes.

Yet, the adoption curves tell a different story. AI has surged ahead, embraced by corporations, governments, and individuals alike, with ChatGPT becoming a household name in just a few years. Markets, on the other hand, are still narrowly perceived and underutilized. However, as the integration of blockchain / DeFi accelerates, the possibility of markets becoming more versatile is tangible. The question is not whether markets can match AI’s influence, but whether we are prepared to let them guide us toward a more decentralized, truth-oriented decision-making process…

Prediction Markets

Prediction markets are straightforward yet powerful: participants place bets on potential outcomes, converting collective beliefs into a single probability metric. The core principle is “skin in the game.” Traders have real money at stake, incentivizing them to analyze information critically and rationally. Unlike polls, which often reflect social biases or the loudest voices, prediction markets aggregate diverse views, making them (potentially) more reliable indicators of outcomes.

These markets especially excel in scenarios where information is fragmented and rapidly evolving. They provide a mechanism for integrating disparate insights, whether it’s the probability of an election outcome, the approval of a new drug, or even the weather.

Polymarket

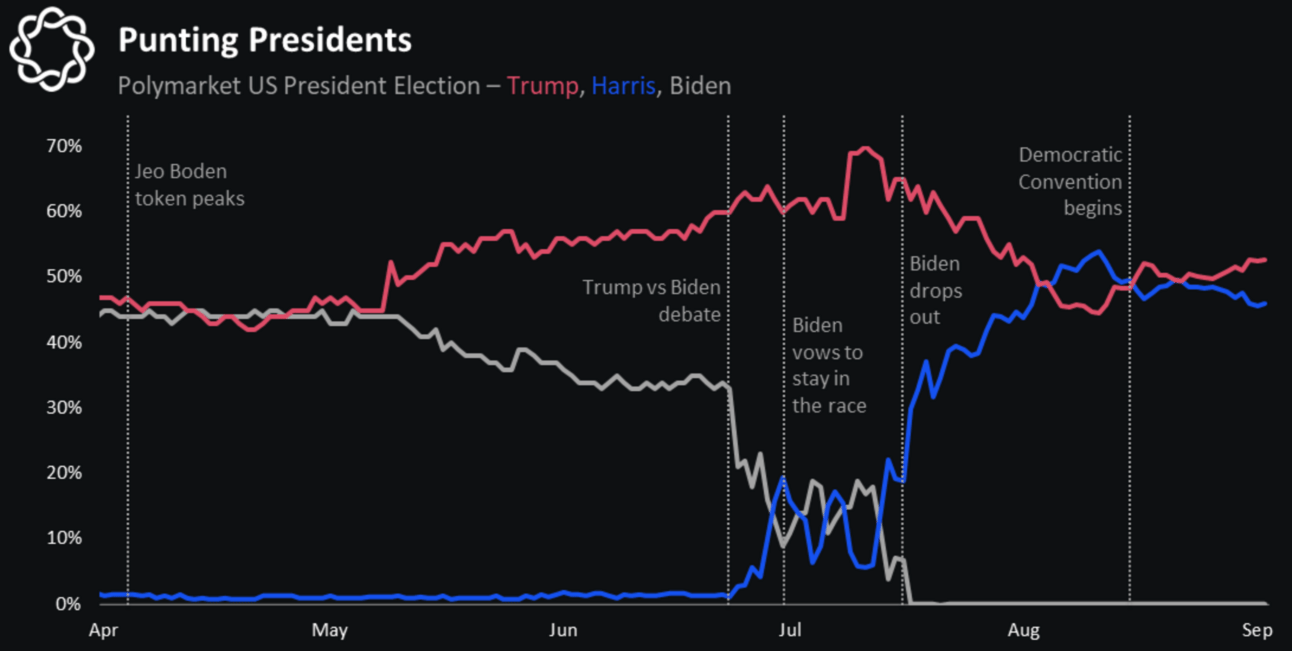

Polymarket is the most prominent startup in this sector, and it also happens to be blockchain-native. It has recently carved a niche in political forecasting, demonstrating the power of decentralized markets to aggregate early signals. During this cycle’s US presidential campaign, Polymarket traders accurately priced a 22% chance of Biden dropping out over a year before the event, even as media narratives suggested stability. By mid-2024, when mainstream sentiment finally caught up, Polymarket traders had already priced Biden’s odds as low as 9%.

via Delphi

Beyond politics, Polymarket has also excelled in other domains. In 2023, Polymarket accurately predicted the approval timeline for a key COVID-19 vaccine booster, outperforming medical experts and financial analysts. It has also demonstrated success in macroeconomic forecasting, such as accurately predicting the Federal Reserve’s interest rate decisions in multiple cycles over the past two years.

But Polymarket’s predictive accuracy suffers as liquidity proves to be a central issue—large trades often face high slippage, making ‘true’ market prices rather volatile. Illiquid markets beget inefficient markets. In this case, that comes at the expense of limiting truthfulness (less accurate and therefore reliable information).

Polymarket has also faced challenges related to oracle reliability. In a case involving a bet on the gender of Justin Bieber’s baby’s (lol, I know), oracles struggled to reach a clear resolution, despite strong evidence suggesting a boy. This was due to technicalities in Polymarket's rules, leading to disputes among UMA voters, who initially rejected the ‘boy’ outcome. Although this case was ultimately resolved in favor of the bettors, it underscores the need for newly-designed oracles that can handle complex resolutions while still prioritizing transparency.

Negatives aside, the product’s potential integration with DeFi is highly anticipated as it currently resides on Polygon. A native token could incentivize liquidity provision, reward market participants, and attract a broader user base—simultaneously increasing market efficiency and aligning user incentives with the platform’s growth.

Decision Markets

Decision markets build on prediction markets’ strengths, but introduce a key difference: instead of outcomes, they allow participants to bet on ‘proposed actions’. Rather than predicting if an event will occur, traders bet on whether a particular decision should be made.

This shift in focus makes decision markets a powerful tool for decentralized governance, offering a novel way to align incentives within decentralized organizations. By financially linking decision outcomes to governance, a feedback loop that leads to more efficient and democratic voting systems is created.

Futarchy

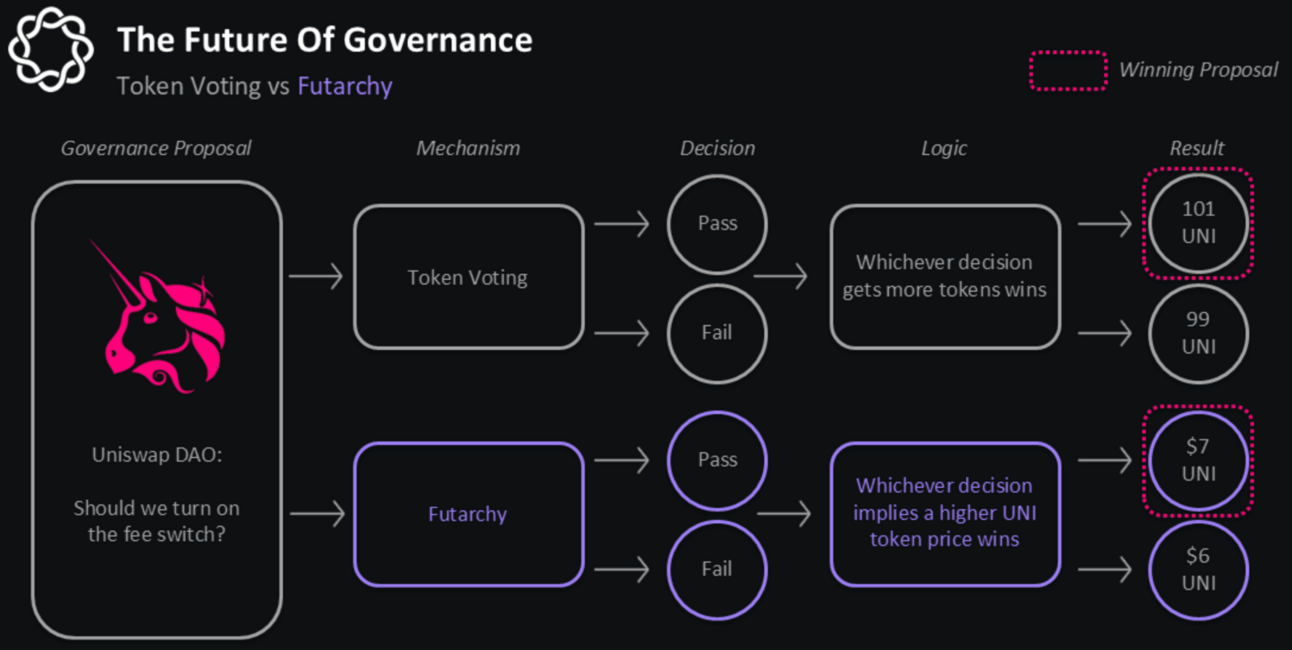

Futarchy, the governance model behind decision markets, is based on a simple yet revolutionary idea: let markets decide what is best. Instead of traditional voting, futarchy asks participants to bet on whether a proposed action will lead to positive outcomes. The theory is that markets, given sufficient liquidity and clear metrics, can make more accurate decisions than traditional governance systems.

In other words, decisions are being made through the market-based predictions of their consequences. Participants are effectively betting on whether the decision will increase or decrease a specified metric—usually token price (interchangeably company value). The intention is to create more rational decision-making, as traders are financially incentivized to choose the most beneficial actions.

Rightfully so, critics argue that futarchy’s success hinges on the assumption that all outcomes can be financially quantified (which isn’t always feasible). As such, implementing futarchy at scale requires addressing several complex challenges:

Liquidity must be sufficient to ensure accurate price discovery

Oracles must be reliable and capable of resolving outcomes transparently

Selecting clear, quantifiable metrics is essential, as complex governance scenarios often lack easily measurable indicators

MetaDAO

MetaDAO is the first significant implementation of futarchy, using decision markets to govern its operations. In MetaDAO, participants trade conditional tokens—pass or fail—on governance proposals. One of its early proposals, ‘Futard.io’, was a test case for this model. Futard.io was pitched as a memecoin product that essentially promised “big returns”, but lacked any strategic alignment. The decision market overwhelmingly bet against the proposal, leading to its rejection. Such an outcome demonstrates how financial stakes can filter out low-value initiatives that may have otherwise passed in a traditional voting system.

via Delphi

As expected, MetaDAO has its flaws. The platform’s user interface can be confusing, featuring three token prices—spot, pass, and fail—which is generally overwhelming for new users (and especially as I explain it). Liquidity is once again a limiting factor with low trading volumes resulting in high slippage, deterring large traders and reducing the accuracy of market signals thus far. Lastly, MetaDAO faces challenges in metric selection. While price is a clear indicator of value, it doesn’t capture broader metrics like community growth or user satisfaction. A comprehensive decision-making engine necessitates data that provides a more holistic view of success.

I still find MetaDAO’s implications profound. If scaled correctly, this model could extend beyond our industry, potentially reshaping corporate strategy, public policy, and other sectors where decision-making is crucial. The experiment is still in its early stages, but it represents a foundational shift toward financialized governance, where decisions are driven by aligned incentives rather than social consensus.

In Sum

AI and markets both represent unique forms of superintelligence, but markets have been underappreciated as mechanisms of truth discovery and decision-making. Prediction markets like Polymarket demonstrate how decentralized systems can aggregate information more accurately than polls, while decision markets like MetaDAO illustrate the potential of financialized governance.

Whether we see prediction and decision markets as novel experiments or foundational shifts, one thing is clear: markets have far more to offer than just asset pricing. They could very well be the next step in decentralized intelligence—a blend of human intuition and financial incentives that guides us toward smarter decisions.