- Moto Capital

- Posts

- November Nirvana

November Nirvana

Up Only

Disclaimer: This post contains thoughts on crypto, a volatile and risky asset class. It is not investment advice, and you should do your own research. All information is for educational purposes only. Please don’t take risks with money you’re not willing to lose.

Building on last month’s positive momentum, November brought Bitcoin’s first attempt at $100k with tokens across the board benefitting from the trend. Price action was primarily supported by speculation coming to fruition with a pro-crypto administration taking the presidency as well as improving external sentiment. Amidst these developments, total crypto market capitalization also made various new highs, with notable contributors being legacy coins such as XRP. Bitcoin’s dominance, or BTC.D, has since fallen from nearly 62%, signaling a potential capital flow from majors to alts in the coming weeks.

via Coinglass

Crypto Wins Election

The 2024 US presidential election underscored the growing political influence of crypto and its industry leaders. In fact, crypto-focused political action committees, or PACs, played a pivotal role in electoral outcomes. Fairshake—with notable funding from Coinbase, Ripple Labs, and a16z—invested roughly $135 million to support candidates advocating for favorable crypto policies. As a result, 48 of the 50 they endorsed ended up winning, thereby granting the industry greater influence in Washington. The most significant victory was the takedown of crypto skeptic Senator Sherrod Brown in Ohio, wherein Fairshake allocated over $40 million to the opposing candidate. Beyond mere financial contributions, the emergence of a ‘crypto voting bloc’ became evident. According to a national survey conducted by the Digital Chamber, 1 in 7 likely voters identified crypto policy as a decisive factor in their voting preferences, reflecting bipartisan support for prioritizing regulation at the federal level.

Donald Trump’s win further ushers in a new era for crypto—void of legal onslaught and hazy regulation. Just recently, this was exemplified with the (albeit anticipated) resignation of SEC Chair Gary Gensler, which will become effective January 20, 2025. As alluded to in past writings, the Gensler regime has been rather destructive towards crypto. Examples include exhausting lawsuits against major US-based companies such as Coinbase and Ripple for operating without proper regulatory oversight. Nonetheless, his departure is expected to lead to a more lenient approach where litigation pressures don’t need to stifle sovereign innovation.

Other political developments;

Senator Cynthia Lummis expressed confidence that the Strategic Bitcoin Reserve bill could be passed within the first 100 days of Trump’s presidency

Elon Musk and Vivek Ramaswamy were announced as the leaders of a newly proposed ‘Department of Government Efficiency’

Bitcoin’s Biggest Bull

Alongside the improving regulatory environment, MicroStrategy continued to buy BTC throughout the past month, lending part to the upwards pressure towards $100k.

MicroStrategy, originally a business intelligence software company, has transformed into a significant Bitcoin holder under the leadership of co-founder Michael Saylor. Since August 2020, the company has adopted Bitcoin as its primary treasury reserve asset. This strategy has led to a strong correlation between MicroStrategy's stock price and Bitcoin's market value.

Aside from raising, MicroStrategy has financed its purchases using methods such as share sales and convertible bond offerings. Just earlier this month, they announced plans to attain $42 billion through equity and debt to buy an additional 600,000 BTC (effectively increasing ownership to 3% of the total supply).

Quickly acting on this goal, MicroStrategy made its largest Bitcoin buy to date, adding 55,500 BTC to the stockpile between November 18-24 for $5.4 billion. The company now reportedly holds ~386,700 BTC, acquired at a total cost of $21.91 billion, averaging $56,658 / token.

As a motif throughout this cycle, Saylor’s TWAP has had massive price implications when compounded with bullish setups. This time was no different.

Dinos Outperform

As best articulated in “The Foundation”, attention in crypto rapidly shifts. In October, focus was intensively saturated on AI agents and the memecoins that developed around them. Early November brought TikTok-based tokens as hints of retail gave rise. However, most recently outperforming all sectors (and rather unexpectedly) have been legacy alts, or what I like to refer to as ‘dinos’.

For instance;

Top performers (top 100) since the election.

If you caught none of these, you're not locked in enough.

If you caught all of these, you need to quit trading and seek help.

— Hsaka (@HsakaTrades)

8:35 PM • Dec 1, 2024

All five of these tokens pre-date the FTX demise, DeFi summer, and even Solana’s launch. As such, they’ve faced multiple corrections throughout several cycles, yet offer comfortability to the seasonal tourists who recognize them from past visits. Among other reasons, the general thesis is: retail is beginning to trickle in—exemplified via increasing ETF inflows and social sentiment—and their first choice is an old friend. Utility coins admittedly deserve their time in the spotlight as this cycle has primarily been dominated by quite the opposite. In previous bull runs, it’s also been common to see these funds eventually find their way into riskier assets as new investors experiment. Regardless, fresh liquidity in any ecosystem is a net positive for crypto.

Hyperliquid TGE

Nicely rounding off the month with stimuli for early users, Hyperliquid, a fan-favorite decentralized perpetuals exchange, finally launched its native token, $HYPE.

Hyperliquid operates as a decentralized exchange (DEX) specializing in perpetual futures contracts, offering traders deep liquidity and high-speed transactions. The protocol aims to provide a seamless trading experience with competitive fees and a user-friendly interface.

Living on its own L1 and void of VCs, Hyperliquid has been uniquely positioned from day one to compete with the top protocols. Led by an incredibly talented founder, not only does HL do well over $1 billion in daily volume, but community sentiment has long been positive as they consistently reward early users. The successful airdrop—where some received north of 7 figures upon launch—only solidified this notion.

Tokenomics

The total supply of $HYPE is capped at 1 billion tokens. During the token generation event on November 29, 2024, 31% of the total supply was sent to the community, making it one of the largest community-based token distributions in DeFi history. An additional 38.8% is allocated for future community rewards and emissions, 24% supports core contributors, 6% is reserved for the Hyper Foundation treasury, and 0.3% is designated for grants.

Market Reaction

Notably being a refreshing escape from the ponzinomics of VCs, CEXs, and MMs, $HYPE has had one of the best launches in recent memory;

price surged by 125% within hours of TGE

peaked at $9.87 → fully diluted valuation of $4.2 billion

has since bounced between mid $8s and the highs

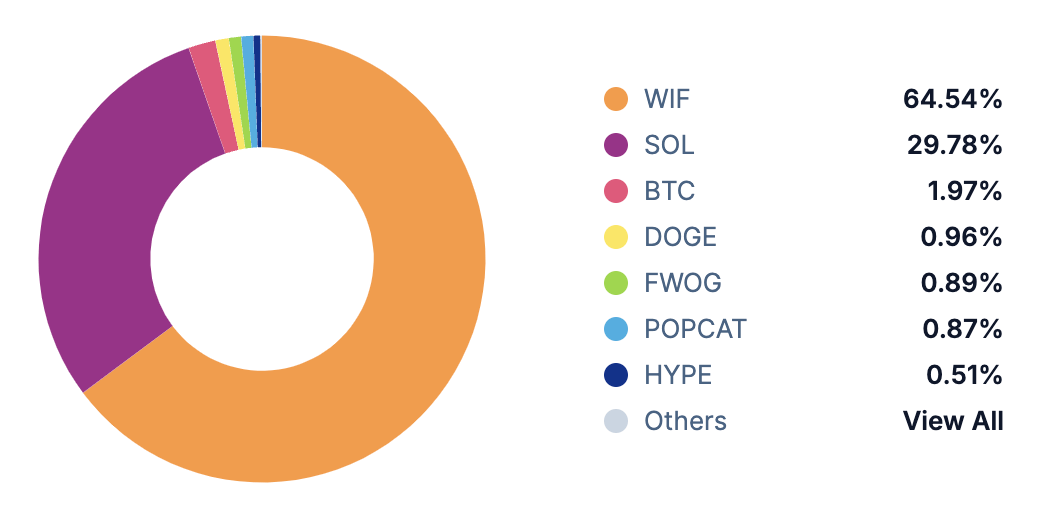

Portfolio Update

Using Hyperliquid as my go-to perps DEX, I was both airdropped some tokens and decided it would subsequently be worth it to market buy post-launch. As a result, a small percentage of my total portfolio has been reallocated to $HYPE, at an average price of $5.50 (current: ~$8.60). Aside from this change, WIF remains my top holding. Long and strong.