- Moto Capital

- Posts

- July Sigh

July Sigh

Going Through the Motions

Disclaimer: This post contains thoughts on crypto, a volatile and risky asset class. It is not investment advice, and you should do your own research. All information is for educational purposes only. Please don’t take risks with money you’re not willing to lose.

Although general consensus defines summer markets as quiet, July has been a historically positive month for crypto - this year was no different. Amidst shifting political tidings and the ever-looming Mt. Gox repayments, majors have held well as the National Bitcoin Conference saturated hope and attention.

via Coinglass

Ether ETFs Debut

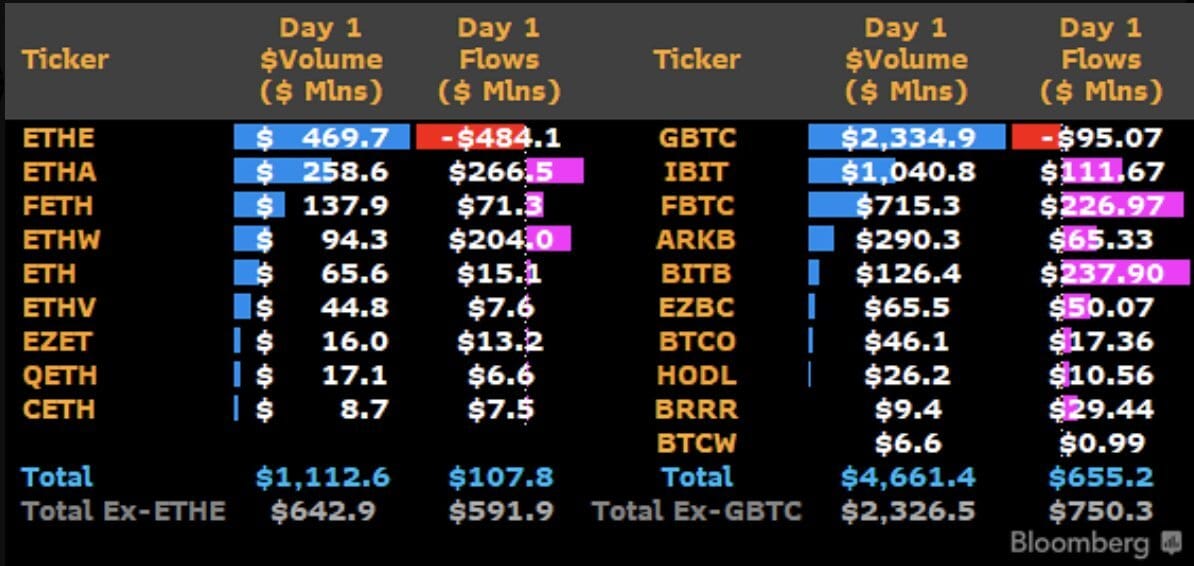

As of July 23rd, the nine approved Ethereum exchange-trade funds officially launched in US markets. While the various BTC ETFs have been massively successful - raking in $17B in net inflows since January - it was expected that spot Ether funds would be smaller due to the relative market sizes and familiarity.

As such, opening day for ETH ETFs paled in comparison to BTC ETFs in a similar timeframe. While both were successful, ETH’s day one flows represent less than 20% of what BTC saw during its debut. However, if you exclude Grayscale’s primary products (ETHE & GBTC), this metric actually becomes much closer in value. In fact, every Ether fund besides ETHE has seen positive inflows for the past week. While somewhat anticipated, this notably highlights that the current success of ETH ETFs is overshadowed by Grayscale’s heavy selling (a pattern that similarly emerged with GBTC).

via @JSeyff

ETHE was already trading at NAV (net asset value) during conversions, unlike GBTC, which was still trading at a discount when its spot ETFs were introduced.

ETH ETF Dashboard via degenz.finance

Make Crypto Great Again

Although I’m watching bears push the monthly candle red as I write this (sigh), most of the month’s positive price action seemed to revolve around former President Donald Trump’s keynote speech at Bitcoin 2024 in Nashville.

The national conference took place this past weekend and hosted the likes of Cathie Wood, Michael Saylor, and even Edward Snowden. Among the smaller names were notable senators like Cynthia Lummis and Bill Hagerty. Despite the star-studded lineup, all eyes were on Trump as he increasingly positions his 2024 campaign as pro-crypto. While I’d recommend watching the speech yourself as crypto’s relevance in the presidential race will only grow, I’ve handpicked what I believe are the most impactful quotes:

In just 15 years, Bitcoin has gone from merely an idea posted anonymously on an internet message board to being the ninth most valuable asset anywhere in the world. Can you believe that? Is that right? That’s a big deal.

For three and a half years, the current administration has waged a war on crypto and Bitcoin like nobody’s ever seen before. For those who work in this industry, they target your banks. They choke off your financial services. They block ordinary Americans from transferring money to your exchanges. They slander you as criminals.

You have the SEC, you know what they’re doing. Obliterating Bitcoin. The reason could not be more clear, because Bitcoin stands for freedom, sovereignty and independence from government coercion and control.

On day one, I will fire Gary Gensler. I will appoint a new SEC chairman who believes America should build the future, not block the future.

Upon taking office, I will immediately appoint a Bitcoin and crypto Presidential Advisory Council. Their task will be to design transparent regulatory guidance for the benefit of the entire industry, and they will get it done in 100 days.

They want to move the creation of a central bank digital currency. It’s over. Forget it. CBDC. There will never be CBDC while I’m president of the United States.

The danger to our financial future does not come from crypto. It comes from Washington, DC. It comes from trillions of dollars in waste, rampant inflation and open borders. It comes from printing hundreds of billions of dollars to fund endless wars overseas, while our cities are like combat zones here at home.

Many Americans do not realize that the United States government is among the largest holders of Bitcoin. The federal government almost has 210,000 BTC or 1% of the total supply that will ever exist. But for too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your Bitcoin. And so as the final part of my plan today, I am announcing that if I am elected, it will be the policy of the administration, United States of America, to keep 100% of all the Bitcoin the US government currently holds or acquires into the future, we’ll keep 100%. This will serve, in effect, as the core of the strategic national Bitcoin stockpile.

Trump ultimately said absolutely everything that the crypto community wanted to hear. We got a pledge to fire Gensler, promise of a council for regulatory framework, and most importantly, the official announcement that Bitcoin would become a national reserve currency under his presidency. However, Donald Trump is without a doubt a businessman, marketer, and perhaps even a manipulator (all politicians are). Moreover, presidential candidates love to overpromise and underdeliver. I’m certainly not placing any concrete bets on any of this coming to fruition, but at the very least it brings our industry to the forefront of political conversation and social narratives.

FOMC Meeting

To round off the month, the Federal Reserve met over the past two days to discuss inflation rates, unemployment, and other important economic indicators.

Key Findings:

labor costs continue to slow

unemployment is up

inflation has eased, but still remains ‘elevated’

As a result, the Fed has once again decided to hold interest rates steady at 5.25% - 5.50%. However, Chairman Jerome Powell did mention that “a reduction in the policy rate could be on the table as soon as the next meeting in September”. Even the FOMC’s official statement reads dovish, signaling that cuts may be on the horizon.

If all goes well, low interest rates + a pro-crypto administration = a good end to the year.

Portfolio Update

My positions have remain unchanged throughout the past month and will stay that way until BTC takes a worthy shot at new all-time highs. Apart from spot holdings, I’m long ETH in hopes that ETF flows flip positive as ETHE selling subsides. Short-term bearish, medium-long term bullish :)