- Moto Capital

- Posts

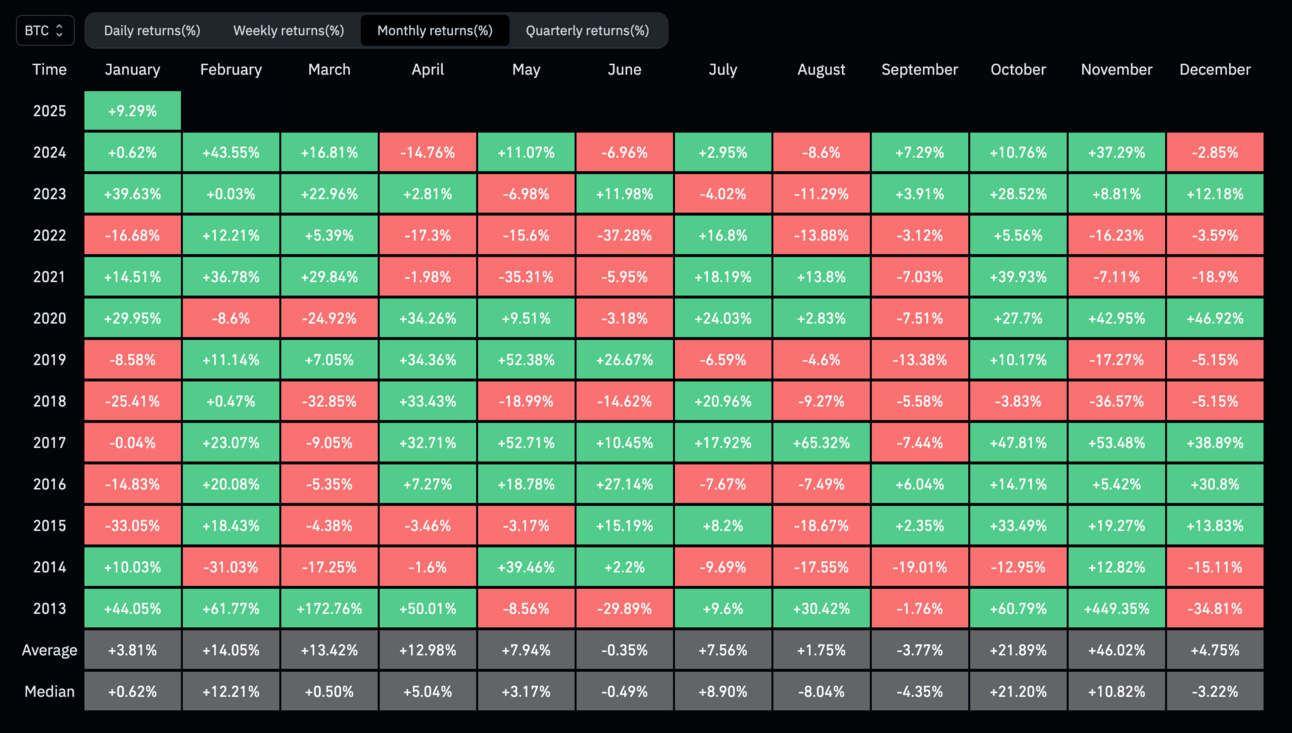

- January Shakeout

January Shakeout

Volatility Death

Disclaimer: This post contains thoughts on crypto, a volatile and risky asset class. It is not investment advice, and you should do your own research. All information is for educational purposes only. Please don’t take risks with money you’re not willing to lose.

January was easily one of the wildest months in crypto’s decade-spanning lore. Amidst the presidential changing of the guards and its potential becomings, expectations coming into the new year were high. With SOL further chasing down ATHs, it felt as if we were on the cusp of a 2021-style alt season. Instead, verifying this cycle’s motif that consensus is often wrong, or more likely, that Trump is a wildcard, the opposite was true. You can see the pain in the charts. BTC violently whipsawed $5-10k in each direction while the timeline correspondingly oscillated from ‘We’re so back’ to ‘It’s so over’. As a result, leverage seekers were repeatedly wiped while alts got chopped to bits. Bit grim, but beyond the chaos, several political developments keep bullish sentiment alive throughout 2025.

via Coinglass

Presidential Currency

Just three days before his inauguration, Trump launched the aptly named TRUMP on Solana. What initially reignited narratives of the ‘memecoin supercycle’ quickly unraveled into a vast liquidity drain. Though its fully diluted valuation remains significantly lower as the estate owns 80% of the supply (lol), TRUMP reached a market capitalization of $90b within 24 hours, surpassing every other SOL-native token in its wake. However, this sudden rise came at the expense of the entire market. Alts ruthlessly bled as capital rotated into TRUMP, reinforcing a broader trend of thinning liquidity outside of major narratives. The situation only worsened when Melania subsequently needed her share of the pie, launching yes, MELANIA, just a day later. A glowing endorsement turned into value extraction. Momentum has since stalled, yet TRUMP remains a consistent top 10 token across futures trading volumes.

Despite its impact on [my bags], this launch was one of the largest onboarding events in recent history. Nearly half of its buyers were first-time crypto users, underscoring the token’s reach beyond our existing echo-chamber.

via Chainalysis

Alas, Regulation

More meaningfully contributing to our industry, one of the administration’s first executive orders was titled, “Strengthening American Leadership in Digital Financial Technology”. At a glance, this EO establishes federal policy to support the responsible growth and use of digital assets / blockchain technology across all sectors of the economy. There’s naturally lots of the same political jargon we’ve heard before, but three things stand out:

Potential for a ‘Digital Assets Stockpile’ - Although still not official, talks of BTC as a reserve currency have long existed since Cynthia Lummis’ drafting of the Bitcoin Act. Among other directives, the EO mandates that within 180 days, the Working Group propose a recommended federal legislative and regulatory framework supporting the order's policy goals for digital assets. This includes assessing the merits and potential criteria for creating and maintaining a ‘digital asset stockpile’, which likely involves assets seized through federal law enforcement efforts.

Ban of Central Bank Digital Currencies (CBDCs) - Eliminating a rather large institutional threat, the EO further prohibits federal agencies from undertaking any action to establish, issue, or promote CBDCs. It also directs departments / agencies to identify and recommend regulations affecting the digital assets sector that should be rescinded or modified.

Repeal of SAB121 - While not directly part of the EO, but rather the first action taken of many, the SEC finally got rid of Gensler’s villainous origin story. Previously, the rule forced banks to record customer-held crypto as liabilities, discouraging institutional involvement. With its repeal, banks can now provide custody services without balance sheet penalties.

These developments offer a stark departure from the previous administration’s regulatory chokehold, signaling that digital assets are now being positioned as a strategic asset class rather than a systemic risk.

More ETFs

With BTC and ETH exchange-traded funds having set a compelling precedent, alongside the expectation of a more supportive government, crypto-native filings have been pouring in. Grayscale, for example, recently submitted an application to convert its existing XRP Trust into an ETF. Dozens more across different providers came in just after Gary Gensler’s last working day on January 20.

It was also leaked that the Chicago Mercantile Exchange (CME) is preparing to launch both XRP and SOL futures contracts on February 10, pending regulatory approval. If successful, these would offer both standard and micro-sized contracts, allowing traders to manage risk and scale positions with greater precision. This not only enhances liquidity and provides more sophisticated trading instruments for institutional investors, but it opens the door to speculate on the timing of the inevitable launch of their respective spot offerings. For reference, it took ETH just under three years. Under a new regime, this likely becomes much shorter.

Portfolio Update

With uncertainty around macro, the liquidity blackhole that was TRUMP, and virtually every KOL calling for the cycle top being in, it felt fitting to shave some of my SOL holdings as it surged past its previous ATH of ~$260. For anyone that’s been around here for awhile, Solana has had one of the most miraculous comebacks ever. The ecosystem was obliterated by FTX’s mess, dumped sub $10, and made a laughing stock by most. Today, it’s leading in all onchain metrics, a clean 26x off 2023 lows, and you’re made a laughing stock if you don’t own it. Aside from BTC, being one of the first tokens to reclaim last cycle’s highs is meaningful enough to take some chips off the table. I’ve reallocated these profits into USDC and have no plan to redeploy for the time being.

Lmfao nah cycle top

Wtf ATH? ok lfg

We nuked I knew it bro lmfaooo

Cycle top in ig then, idk?

Wait we bounced

Aight new ATH next

Nah nvm fuck this

Top, but I'll long range low

Front run, lol imma scale long this crab

Maybe...

Nah fuck this FUCKING shit bro

Uhh up a… x.com/i/web/status/1…

— Doc (@docXBT)

4:56 AM • Jan 28, 2025