- Moto Capital

- Posts

- Into the HyperEVM

Into the HyperEVM

Building the Stack

Disclaimer: This post contains thoughts on crypto, a volatile and risky asset class. It is not investment advice, and you should do your own research. All information is for educational purposes only. Please don’t take risks with money you’re not willing to lose.

If my prior writings didn’t detail it well enough, trading IS the most important product of this cycle. While the SOL casino thesis undoubtedly made way for meme-adjacent unicorns such as PumpFun, no emerging ecosystem has boasted nearly as much success as Hyperliquid.

For the uninitiated, Hyperliquid is a performant L1 that began as a decentralized perps exchange. Imagine onchain Binance. En route to scaling, HYPE was launched and distributed amongst early participants, infamously becoming the largest (and thus most profitable) airdrop in history. Suffice to say, their userbase and existing liquidity is sticky so long as incentives remain.

On that note, what’s lesser known about this novel protocol is that there’s another wave of token allocations to be released to the community. No, it won’t match an underfarmed ‘Season 1’, but still offers reason to explore the opportunity for those who feel they initially missed out.

Bird’s Eye View

While more neatly outlined in “The Everything Exchange”, Hyperliquid can be considered a dual-engine system. Most users only ever touch one side, HyperCore, the backbone of the perps exchange. This is the performance layer… custom-built, hyper-optimized, and where the chain handles trading, order matching, and block production. It's how the protocol can clear billions in daily volume while still feeling faster than most CEXs.

Conversely, the launch of HyperEVM introduces a second track, one that brings general-purpose programmability to the same L1. It’s a Solidity-compatible smart contract layer, built natively into the chain rather than slapped on modularly. As a result, there’s no rollup delay, no reliance on external DA, and no bridging games. Just one unified chain with two execution tracks: one for trading and one for DeFi.

While HyperCore processes orders, HyperEVM enables applications that can tap directly into those orders, balances, and state changes. It’s one of the first serious attempts to vertically integrate the DeFi stack at the chain level, not just at the UI layer.

The reason most onchain perps DEXs stall out is composability risk. Incentive schemes are siloed. Liquidity is borrowed, not native. Protocols fight over emissions instead of growing a shared pie. Instead, by merging execution and application layers under one roof, HyperEVM breaks that mold. Builders can now deploy DeFi primitives that settle natively into the trading system without needing to re-bootstrap liquidity or depend on already fragmented ecosystems.

Ecosystem

As alluded to, ‘Season 2’ of token incentives is widely expected to reward usage on the HyperEVM, particularly early deployments that drive meaningful TVL, fees, or novel mechanisms. While the team hasn’t confirmed specific metrics, past behavior points to genuine usage being most profitable. Bots, wash trades, and circular farming likely won’t survive here. In fact, the original HYPE airdrop is widely regarded as the most mercilessly farm-resistant design to date.

Whether building, integrating, or even just tinkering as a power user across new dApps, this looming second allocation means there’s still runway for contributors

Many of these deployments are already being incentivized, either directly by the Hyper Foundation or indirectly via speculation of the potential Season 2 airdrop.

How to position:

Bridge to HyperEVM (native is easiest)

Use early protocols, especially those with fee generation

Interact with spot + perps liquidity where integrated

Track emissions to vaults

Join governance calls or testnet deployments

TLDR; This doesn’t require rotating large spot holdings to farm. If you already hold HYPE, consider moving some to the EVM side and engaging directly. If you’re chain-agnostic but strategy-forward, track vault emissions and fee splits as this is where protocols may reward usage most.

By the Numbers

Currently sitting just above $1.5b, total value locked, or TVL, has steadily grown since launch.

via DefiLlama

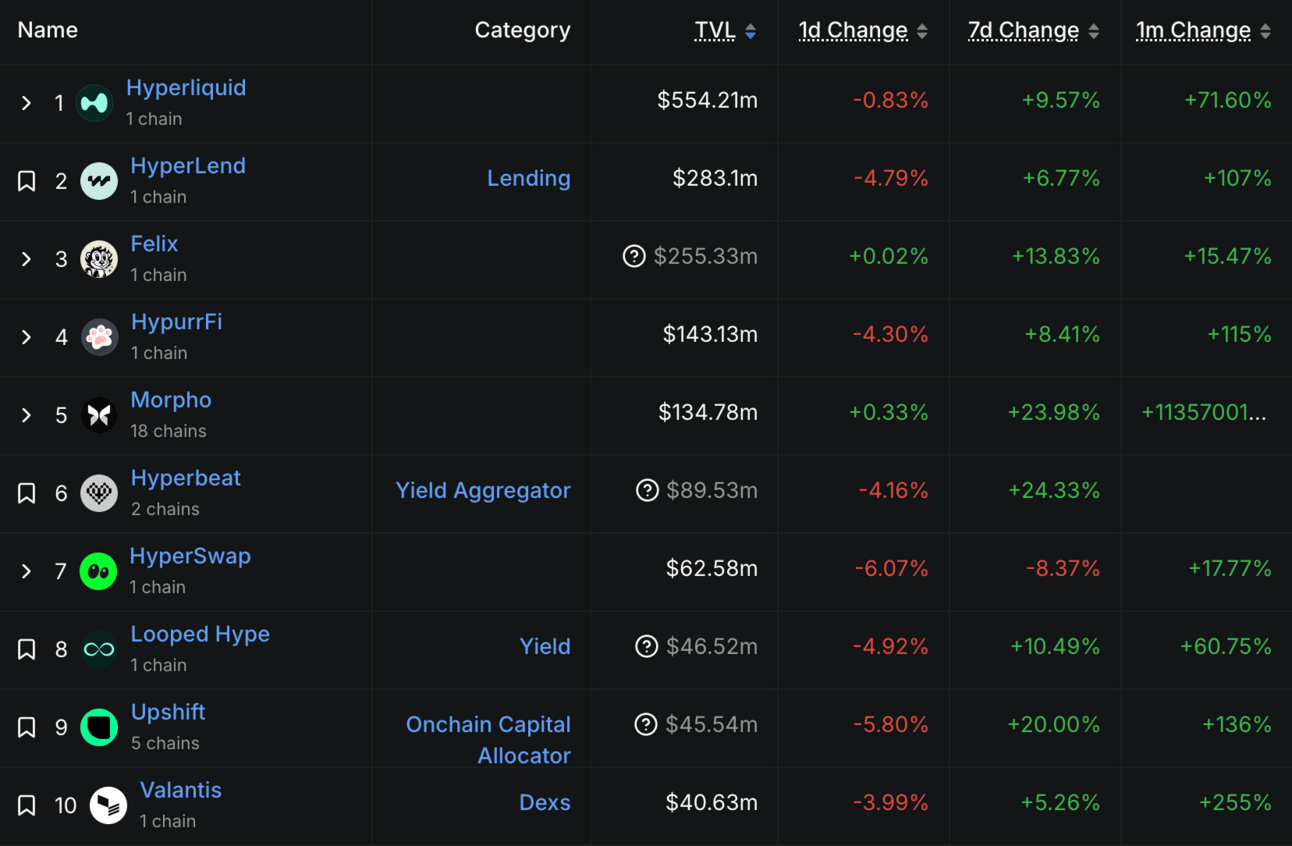

Consistent with this, the leading protocols show positively correlated TVLs over the past month.

via DefiLlama

With regards to onchain activity, both daily transactions and daily unique addresses (or users) follow a similar trajectory.

via Purrsec

via Purrsec

Lastly, and a notable point of stress thus far, is the spike in transaction fees as activity rises. ETH enjoyooors will remember the pain that gas cost them during NFT mania. Thankfully, the HyperEVM is still young and therefore scaling is an issue that I’m sure the team is looking at as more deployments come to fruition.

via Blockscout

In Sum

Hyperliquid’s HyperEVM isn’t just a new chain, but rather a the natural extension of crypto’s most battle-tested exchange. While most new L1s launch with a dream and no users, HyperEVM is already bootstrapped with deep liquidity, thousands of active traders, and the muscle memory of a billion dollar airdrop.

If the early Solana crowd rode memes to the top, Hyperliquid’s shot is to ride volume. Every primitive built here is reflexively tied to its perps engine. Structured vaults deepen liquidity. Options enhance strategy. Protocols don’t just plug into the network, they plug into the order flow. Better yet, all of it is wrapped in a clean incentive shell. Season 1 created real wealth. Season 2, while smaller, may still reward those who are willing to get their hands dirty.